Category: Credit Cards

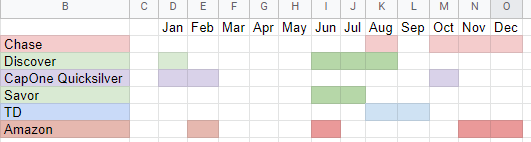

Tracking Monthly Credit Card Usage

by Lulu | Dec 21, 2022 | Credit Cards | 0 |

This year I tried tracking monthly credit card usage for fun. This was easy to set up in a spreadsheet and just looked at what months I used each card. (If you are not reading this post at...

Read MoreNot Paying Rent With My Credit Card

by Lulu | Jan 11, 2022 | budget, Credit Cards, Save Money | 0 |

I am not paying rent with my credit card any more because of the fee. In the past I would use my card to pay rent so I could capitalize on the cash back for every purchase. My rent was classified as...

Read MoreChanging The Way I Pay My Credit Cards…Yet Again

by Lulu | Dec 28, 2021 | Credit Cards | 0 |

I’ve changed the way I use my credit cards and the way I pay them a number of times. This is the beauty of having a budget that is flexible. I use it one way as it suits my needs and then...

Read MoreMissed Some Credit Card Rewards

by Lulu | Dec 23, 2020 | Credit Cards | 0 |

I missed some credit card rewards due to poor planning. I normally rotate my credit card every quarter to take advantage of the cash back rewards. This quarter I used the wrong card and missed some...

Read MoreChanging My Credit Card Method (For Hopefully The Last Time)

by Lulu | Jun 13, 2018 | Credit Cards | 0 |

I’m changing my credit card method one more time. This time should hopefully be the last…unless I get a better card in the future. I’ve written about the way I use my credit cards...

Read MoreHow To Use Credit Cards Responsibly

by Lulu | Mar 14, 2018 | Credit Cards | 8 |

You can use credit cards responsibly by following a few simple tips. Many people are afraid of using credit cards. They see them as some evil tool that will ruin you financially. Yet others, like...

Read MoreUpdate on Ally Cash Back

by Lulu | Feb 7, 2018 | Credit Cards, Finances | 0 |

I got some cash back from my Ally card. If you would like to read the initial review of the card please click here. I decided to redeem the cash back to my savings account instead of taking it as an...

Read MoreAlly Cashback Card Update

by Lulu | Nov 15, 2017 | Credit Cards | 2 |

This is an update on my Ally Cashback card. I recently added this credit card to my collection so I could get the bonus. (If you are not reading this post at www.howisavemoney.net or in your feed...

Read MoreAlly CashBack Visa Signature: Card Review

by Lulu | Oct 18, 2017 | Credit Cards | 0 |

The Ally CashBack Visa Signature card is finally in my hands! If you don’t know what that is then read on for more details. I received an invitation in the mail to apply for the card. I was...

Read MoreI’ve Been Robbing Myself Of My Credit Card Points

by Lulu | Sep 27, 2015 | Credit Cards | 0 |

I have been robbing myself of my credit card points without even knowing it. I have the Citi double cash back card and I love it. With this card you effectively earn 2% cash back on all...

Read MoreUsing Discover CashBack Bonus To Pay For Amazon Purchases

by Lulu | Jul 6, 2015 | Credit Cards | 0 |

I have a Discover card that gives cash back in the form of the Discover Cashback bonus. I love this card because even though the categories rotate, you can get 5% cash back from purchases in...

Read MoreTrying (And Failing) To Use One Credit Card For A Whole Month

by Lulu | Jun 1, 2015 | Credit Cards | 0 |

I have been trying to use only one credit card for a whole month so that I can maximize my rewards from that card. I have also been failing at that goal because I simply cannot stick to one card. I...

Read More

Recent Comments